IRS Form 941: Fillable PDF & Instructions

IRS 941 Fillable Form: Guide to e-File Quarterly Tax Report

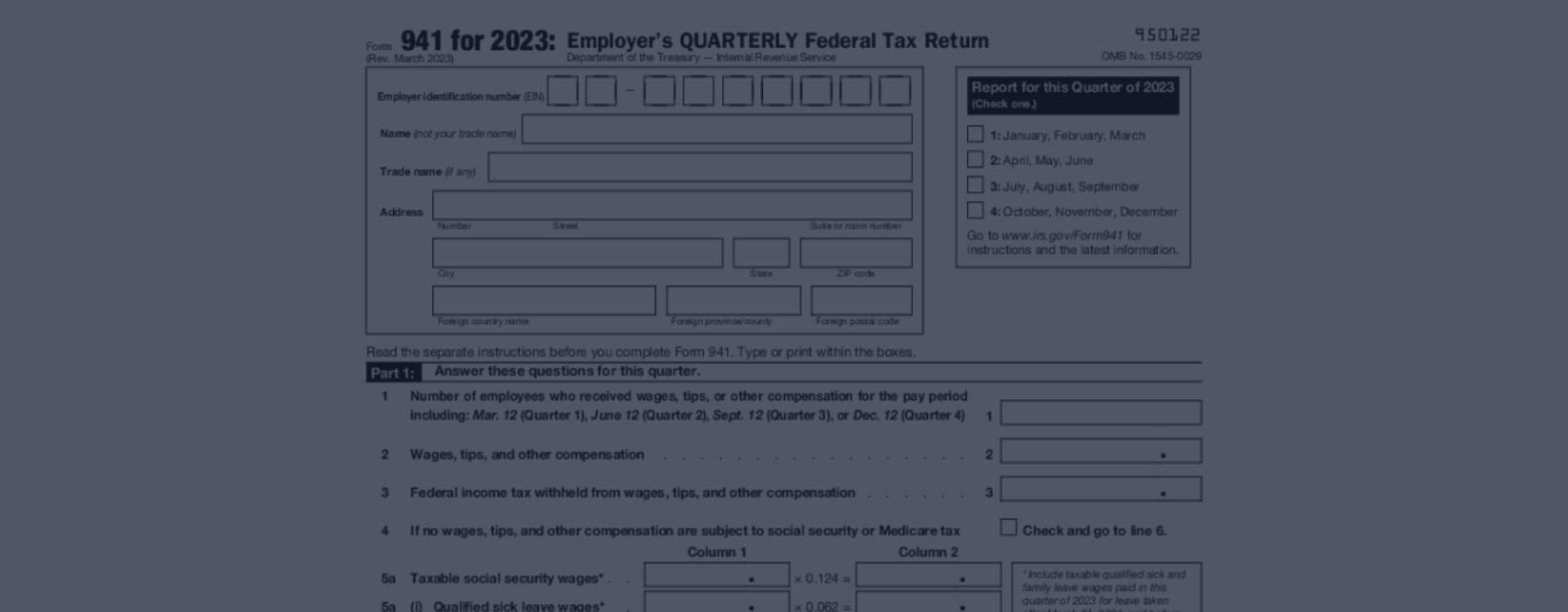

IRS Form 941 is a remarkable document that businesses in the USA use to report their employees' income, things like the social security and Medicare taxes withheld. This isn't just limited to a list of employee salaries either - the 2023 941 federal tax form also includes details about the tips that employees earn. It's like a one-stop way for Uncle Sam to keep track of employee earnings and the associated tax details. Below are the main pros of the fillable version of the 941 copy.

Sharing the right tools and resources simplifies this process, and that's precisely where our website - 941-fillable-form.com comes to the rescue. Our platform is home to useful materials like instructions and examples, all crafted to simplify your tax life. Specifically designed to assist with the IRS fillable Form 941 for 2023, these resources can hugely simplify the online form-filling experience. Handling the 941 form for 2023 in PDF has never been so easy! Connect with us today and see how to turn the often-daunting tax filing task into a breeze.

The Tax Form 941 Meaning for Qualified Small Business

The 941 form is mandatory for certain individuals responsible for withholding income taxes, social security tax, or Medicare tax from employees' paychecks or for those who pay these taxes on behalf of their employees. In 2023, the IRS 941 fillable form is a handy way to deal with quarterly taxes to avoid paper routines. Let's take a look at the practical example.

IRS Form 941 - Example of Use

Now, let’s consider Jane. Jane runs a bustling cafe in downtown Chicago. She has a small team of 12 employees who rely on her for their weekly paychecks and the accurate deduction of income taxes and Medicare components. She takes pride in running her affairs smoothly and keeping her team content. Every quarter, Jane files the 941 electronically to ensure that all information related to her employees' salaries and related deductions is up-to-date, accurate, and delivered on time to the IRS. In addition, completing this is essential for Jane to remain compliant, minimize mistakes, and avoid potential risks or penalties. The procedure might seem daunting for those new to it. However, to reduce this hardship, a free 941 form for 2023 is available online in a few clicks. It is user-friendly, clearly explained, and easily filled online, streamlining the process. So, like Jane, other small business owners can also easily fulfill their tax obligations with minimal hassle.

Form 941 for in PDF: From Filling to Filing

Let's ease your worries about filling out the IRS fillable 941 form for 2023 with our simple guide. This document is available for free on our website and is essential for submitting your quarterly federal tax. It might sound intricate, but we're here to help you step by step!

Filing your taxes can be daunting, but don't worry. We're here to help. For employers, submitting the Form 941 is especially important. It's a form that needs to be filed quarterly. In other words, it has to be done four times a year.

Form 941 Filing Schedule

The due date to submit your Form 941 varies each quarter, generally falling in the month following the end of a quarter. So you've got April, July, October, and January to mark on your calendar. You can file the 941 quarterly online to make tax filing easier. That means less paper, fewer headaches, and a simpler process.

IRS Tax Form 941: Key Takeaways

- It's really crucial to submit honest information. Providing false details can lead to penalties. And we know penalties are a hassle you'd rather avoid.

- Additionally, make sure you're on time with your submissions. Late filings can also result in penalties. File promptly and accurately to avoid any unnecessary stress!

- Remember, we're here to help. Go ahead and try online Form 941 filing - it's straightforward and saves time.

IRS 941 Tax Form for 2023: People Also Ask

2023 IRS Form 941: More Instructions & Examples

Please Note

This website (941-fillable-form.com) is an independent platform dedicated to providing information and resources specifically about the 941 form, and it is not associated with the official creators, developers, or representatives of the form or its related services.