941 Quarterly Tax Form

In the mid-twentieth century, the Internal Revenue Service (IRS) introduced a new concept, the IRS 941 quarterly form for 2023. This form is designed to provide a summary of the taxes withheld from employee salaries and wages, along with the employer’s portion of Social Security or Medicare tax.

Recent Changes to IRS Form 941

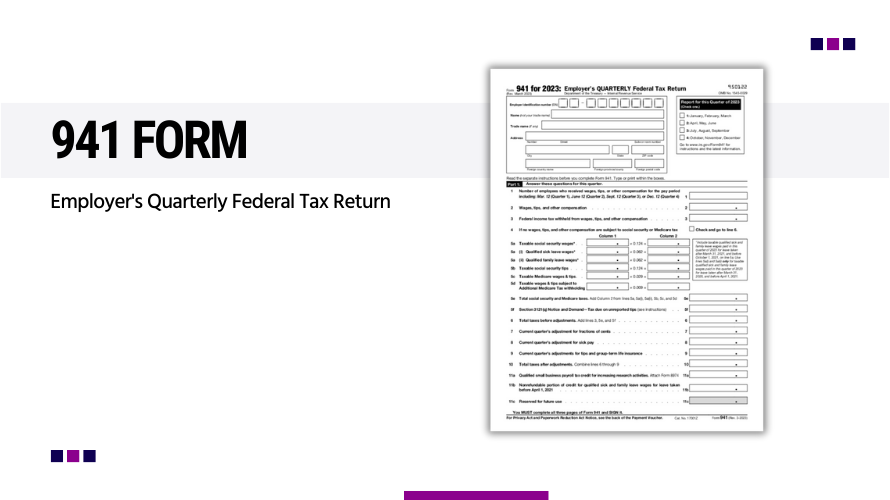

Recently, the IRS has made several significant modifications to this document. The blank 941 quarterly form was simplified and made more intuitive. Additional fields were also introduced to make it easier for employers to provide details about withheld income tax and calculate their tax liabilities. On another positive note, the IRS has also provided a printable 941 quarterly form for convenience.

Who Should Use Form 941, and Who Should Not

Form 941 is primarily designed for employers who withhold income, Social Security, or Medicare tax from employee wages. This includes all public, private, and nonprofit employers. However, it's essential to understand who is not eligible to use this form.

- If you are a seasonal employer and did not pay wages during a particular quarter, you do not need to file a 941 quarterly tax form.

- Additionally, agricultural employers and employers of household employees have their specific forms and, therefore, should not use Form 941.

Optimizing the Advantages of Form 941

Form 941 can offer several advantages when used optimally. It allows employers to keep track of the taxes they have withheld and aids in preventing any tax liabilities. It's crucial to understand that this form must be filled out and filed quarterly to maintain proper tax records. The best way to optimize the advantages of Form 941 is to file the 941 quarterly report electronically. This ensures quicker processing, reduces the chances of errors, and provides a confirmation of receipt, making it a more reliable and efficient option than paper filing.

Protecting Form 941 & Its Sensitive Data

Protecting sensitive data when working with the 941 tax form is paramount.

- Firstly, always use secure and encrypted internet connections when transmitting data to prevent interception.

- Avoid using public Wi-Fi networks for such tasks. It's also wise to store these forms and any soft copies in secure, password-protected locations on your device.

- Consider investing in high-grade data protection software that provides real-time safety against malware and hacking attempts.

- Always shred any unused copies of the form, as these could fall into the wrong hands. Do not share your tax information via email unless it's necessary and the email system is secure.

- Regularly update your computer’s antivirus software for maximum security.

- Lastly, regularly review your tax forms for any signs of tampering or unauthorized access.

Latest News

-

![Printable 941 Quarterly Form]()

- 25 September, 2023

-

![Form 941 for 2023]()

- 22 September, 2023