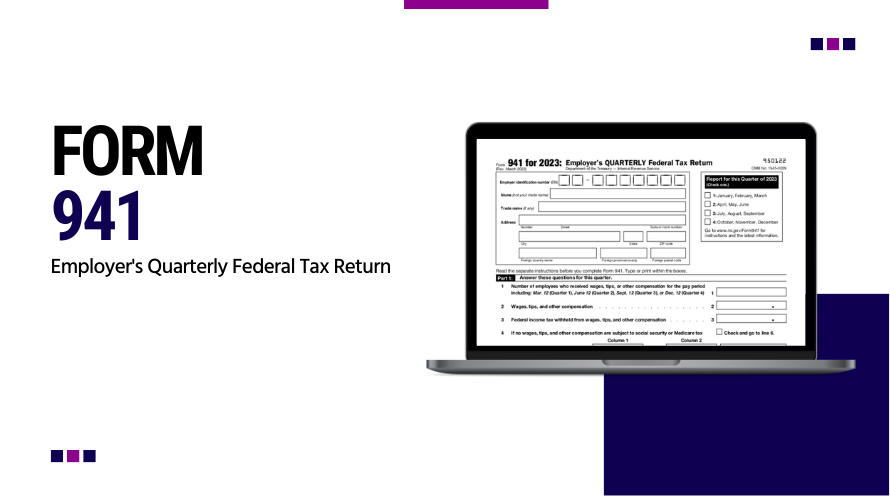

Printable 941 Quarterly Form

When dealing with tax forms, it's crucial to understand their structure to ensure accuracy. One such document is the printable 941 quarterly form employers use to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks. Notably, the form has several primary fields such as "Employer's identification," "Number of employees," "Taxable Social Security wages," and "Total deposits for the quarter."

Guidelines for the 941 Printable Form Filling

- Always use legal business names and addresses.

- Ensure the Employer Identification Number (EIN) is correct.

- Accurately record the number of employees for the quarter.

- Compute the correct sum for taxable wages, tips, and other compensation.

- Don’t forget to add taxable Social Security and Medicare wages.

- Verify the total tax deposits made during the quarter.

How to File the Completed Form 941 in 2023

The process of filing the completed IRS 941 printable form can be quite straightforward. Here's a step-by-step guide to it:

- After completing all the necessary fields, review the form for accuracy.

- If all the data provided is correct, sign and date the form.

- You can then mail the completed 941 tax form printable to the appropriate Internal Revenue Service office. Alternatively, you can e-file the form, which is a quicker and more convenient option.

Form 941 for Businesses with non-U.S. Employees

Completing Form 941 for U.S. businesses cooperating with non-U.S. individuals involves reporting payroll taxes accurately.

- Begin by providing your business information, including your EIN, legal name, and address.

- Next, report wages paid to employees, including U.S. and foreign individuals, in Part 1.

- Ensure that you've properly classified them as employees or independent contractors.

- If you've withheld income tax for foreign individuals under tax treaties or other agreements, ensure it's accurately reflected in Part 3.

- Lastly, calculate your total tax liability, which includes the employer's portion of Social Security and Medicare taxes.

Form 941 Filing Deadline

It's vital to comply with all IRS deadlines to avoid penalties. For the printable 941 tax form for 2023, each quarter's form must be filed by the end of the month following the quarter's end. That means the following:

- if the quarter ends in March, the form is due by the end of April;

- for June, it's due by the end of July;

- for September, by the end of October;

- for December, by the end of January in 2024.

Remember, it's always a good idea to seek the help of a professional in case you have trouble completing the form. Lastly, those who need the blank 941 form for 2023 printable can find it on our website, available for free download.

Latest News

-

![Form 941 for 2023]()

- 22 September, 2023

-

![941 Quarterly Tax Form]()

- 21 September, 2023